The Dangers of Inflation

Jump to:

What is Inflation?

People today often discuss inflation in terms of the rising prices of goods and services, as typically measured by the Consumer Price Index (CPI), a weighted basket of various goods and services. The rising price of goods and services, however, are merely a consequence of inflation. So what is inflation?

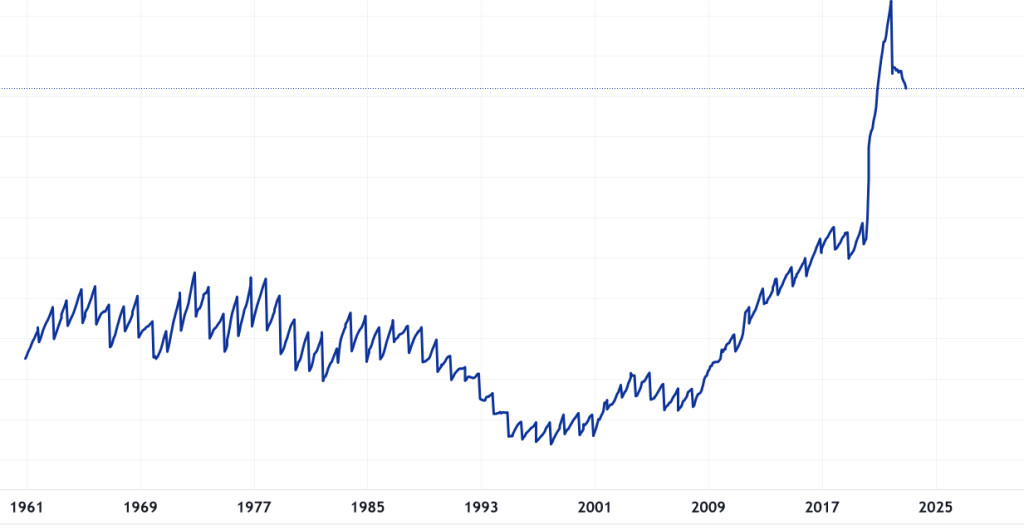

Inflation relates to the amount of money, or currency, in circulation. When currency is created (i.e. lent into existence via mortgages, loans and other forms of credit), there is more currency in circulation and so the currency supply is what has actually been inflated. With more currency chasing the same amount of goods and services it is only natural that the price of those goods and services (measured in currencies) goes up. Of course, if the amount of goods and services available – Gross Domestic Product (GDP) – manages to grow in accordance with the inflation of the money supply, then prices would not need to go up. This is not often the case, however, as economic growth (dependent upon increased energy consumption) cannot be created as easily as currency! A graph of the money supply vs the GDP shows how money supply growth tends to outpace GDP growth and so the cost of goods and service marches on upwards.

How bad is it?

Inflation in the price of consumer goods and services, as measured by the CPI, tends to significantly understate reality. The CPI is measured using a basket of weighted goods, constructed as follows:

| CPI (overall index) | (100%) |

| 01 Food and non-alcoholic beverages | 10.3% |

| 02 Alcoholic beverages and tobacco | 4.2% |

| 03 Clothing and footwear | 7.1% |

| 04 Housing, water, electricity, gas and other fuels | 12% |

| 05 Furniture, household equipment and maintenance | 0.9% |

| 06 Health | 2.8% |

| 07 Transport | 15.3% |

| 08 Communication | 3.2% |

| 09 Recreation and culture | 14.8% |

| 10 Education | 2.5% |

| 11 Restaurants and hotels | 12.3% |

| 12 Miscellaneous goods and services | 9.6% |

For many in the working and middle classes, however, the essentials of housing, utility bills, and food will make up much more than the indicated 22% of their expenditure, as per the CPI basket. In fact, these are more likely to constitute more than half of one’s expenditure, meaning that rises in food, housing and bills, as seen in recent years, tends to adversely impact the 90% rather than the wealthiest 10%.

Moreover, hedonic adjustments are made to argue that the quality of features of services and goods improves over time and so the rise in prices should be ignored as it is accompanied by more functionality. A smart phone of today, for example, cannot be compared with a mobile of the late 1990s. While this is true to an extent, a car is used primarily as a mode of transport so whilst having additional features is nice it does not change the fact that you have to pay more to own a car today than historically.

Real price inflation, therefore, is often understated. Whilst official US CPI data suggests an inflation rate of over 6%, at the time of writing this article, down from its peak of over 9%, attempts to more accurately measure inflation (see shadowstats.com) show it currently above 14%! Official UK CPI inflation on the other hand is currently above 10%, yet most in the UK would admit it feels much higher than that when paying bills and doing the shopping.

Why should I care?

10% Inflation for just one year means that £10,000 in the bank from last year can now only purchase £9,090 worth of goods. If inflation remains this high for 3 years, then £10,000 is equivalent to only £7,513 worth of goods and services. What if actual inflation was 15% or even 20%, as suggested by experience and alternative measures of inflation? Suffice to say that the purchasing power of your currency could have almost halved in just over 3 years! You get the idea…

Would you care if your employer guaranteed that every year your salary will be worth 10% less than the previous year? If yes, then you should certainly care that governments and central banks essentially guarantee you as much through their monetary policy toward inflation.

Protect yourself by saving wisely – own real things (stocks & shares in companies, real estate, bullion etc.) rather than currency!

Learn more about investing in stocks & shares and bullion and protect yourself from inflation with our portfolio insights service.