The Case for Precious Metals

Excess Liquidity & The Covid Bubble

In 2021, cryptocurrencies, biotech, cannabis, technology stocks like Tesla, NVidia, Zoom and Netflix etc and many other so-called growth stocks were all inflated in price to bubble territory as excess liquidity flooded the financial markets through quantitative easing (i.e. currency printing) of epic proportions. The covid-19 policy response meant that governments felt the urge to print stimulus money to keep people spending and the economy afloat whilst travel shut down and people remained locked at home. The US M2 money supply grew, in the space of just one year, by more than a third relative to the US economy (GDP).

With nothing better to do and government furloughs ensuring employees’ salaries and business support loans giving companies access to easy credit, a whole bunch of fresh currency found its way into the markets. With passive investing through ETFs and investment funds being more prevalent now than ever before, money became increasingly channeled into a handful of stocks (most notably the FANGs), whose market capitalisation came to dominate the S&P 500 index in percentage terms.

As interest rates were slashed to zero (or negative in some cases), bond prices soared. With ridiculously low mortgage rates and Stamp Duty tax on property sales needlessly suspended, the real estate market naturally became inflated too, with the UK house price index up by over 20% from 2020 to 2021.

Liquidity was so abundant that even the less liquid markets of collectibles (watches etc) saw significant price inflation.

Alas! It was not to last and when inflation started to show its ugly head in consumer goods, it was only a matter of time before rates had to rise and liquidity start to be pulled away from the markets, as the Consumer Price Index (CPI) started to report inflation not seen in over forty years.

As monetary conditions tightened, 2022 saw the worst combined performance of stocks (-18.1%) and bonds (-17.8%) since 1937 as the portfolio invested in 60% equities and 40% bonds lost almost a fifth of its value. For the investor holding a higher allocation of growth stocks, the portfolio is likely to have lost more than a third of its nominal value – the Vanguard Growth ETF (VUG) being down by 33% in 2022. An even more speculative portfolio could have lost more than half or as much as two thirds of its nominal value – the ARK Innovation ETF (ARKK), for example, epitomising the covid liquidity bubble, being down 67% in 2022.

Gold – The Anti-Bubble

Whilst stocks have had a significant price correction over 2022, they are still not cheap relative to company earnings, on a historical basis. If a recession looms on the horizon, earnings could be susceptible to further decline making the stock market, in aggregate, still significantly overpriced. In this environment, therefore, investors face a dilemma with regard to where they can deploy capital over the next 5 to 10 years. Holding cash over the long term is not desirable as CPI inflation remains high, eating away at the purchasing power of currencies. Interest rates have broken a forty-year downward trend and will likely remain elevated for the considerable future along with inflation, indicating a bear market for bonds too.

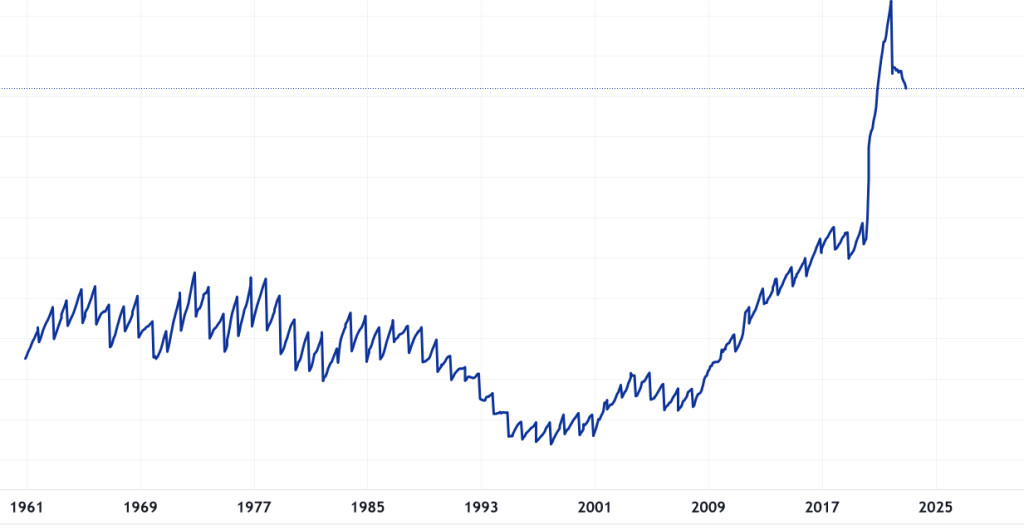

In this situation, holding real assets and in particular precious metals, looks to be a sensible option. Relative to the US stock market, gold looks like the anti-bubble, being as cheap as it was prior to major upward inflections in the gold price in history.

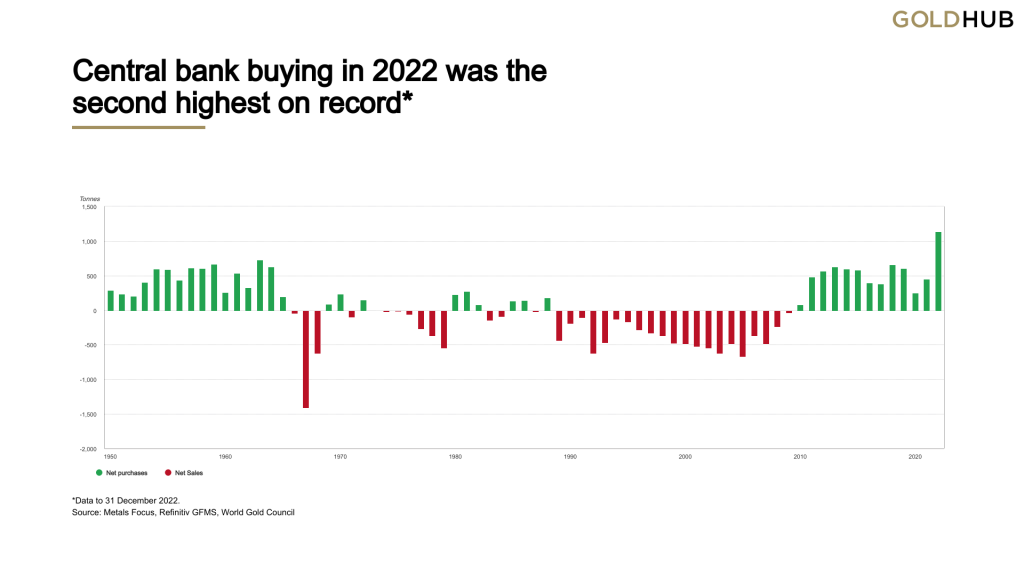

If gold’s relative valuation metrics are not compelling enough, 2022 saw central banks across the world purchase the largest amount of gold since records began in 1950, according to the World Gold Council, leading by example so to speak. This is, at least in part, linked to the current geopolitical climate and uncertainties following the escalation of the war in Ukraine.

Silver’s Time to Shine?

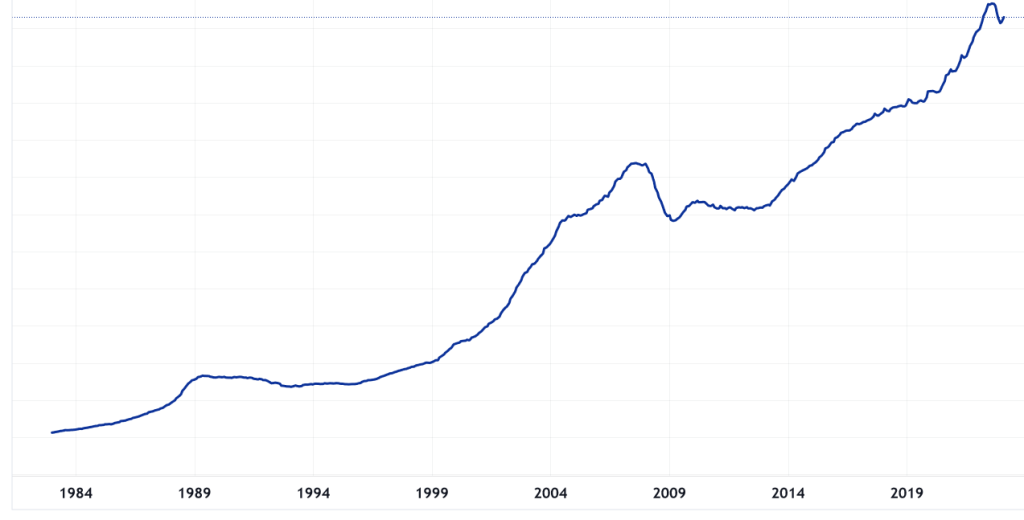

Even cheaper still is silver, which remains about as cheap as it has ever been in relation to gold. One ounce of gold can currently buy over 90oz of silver. If it were merely to revert to mean, one oz of gold should only be able to buy around 65oz of silver, meaning the silver price would need to be 40% higher, assuming the gold price remained where it is. If gold trends upward, as we expect, however, the percentage gain in silver would be higher. And besides extreme over- or under-valuations rarely simply revert to mean, meaning that silver could quite likely overshoot and touch the trend line established by previous spikes in the silver price. If gold were to reach a target price upward of $2,300/oz in the coming few years, and silver were to reprice to such that one oz of gold could buy 50oz of silver, then silver would be near its historical nominal high of $50/oz.

There is also the possibility that it were to become more expensive relative to gold, breaking the 50-year downward trend in the Silver/Gold ratio, and reaching the relative valuation spike (1/30) seen in the last precious-metals bull market of 2011. In this scenario one oz of gold (at $2,300/oz) would be able to buy only 30oz of silver priced around $75/oz, meaning silver would more than triple in price from its current levels of around $20/oz.

To see how we are positioned within the precious metals space, and for ideas on precious-metals-related investments, become a portfolio insights member.

Important Disclaimer

The information offered is for educational and informational purposes only. None of the information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. You must do your own due diligence and/or seek the advice of a financial professional before making any investment decisions. This material is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe to any investment.

Any views and opinions expressed were held at the time of preparation and are subject to change without notice. Swaraj Finance reserves the right to alter their views and opinions at any time based on changes in the financial markets and global economy.